On, September 17, the U.S. House passed a bill (HR 3221), the Student Aid and Fiscal Responsibility Act of 2009, that would effectively abolish the federally subsidized student loan industry and replace it with a system of direct government loans to students. The measure passed 253 to 171, largely on partisan lines. The bill was sponsored by California Democrat George Miller. The Senate will debate a similar measure in the coming weeks.

How should we view this potential change? What does it signify?

The federal government was, after all, already waist-deep in financing college education. The House bill, if it becomes law, seems mainly to shift the delivery mechanism from student-loan companies to the Department of Education. Actually, HR 3221 includes some additional features: $10-billion in grants to community colleges, $8-billion for early-learning programs, $3-billion for grants aimed at improving college access and completion rates, substantial increases in Pell Grants ($40 billion over ten years), a ballooning of the Perkins Loan program from the current $1-billion to $6-billion a year, and $4.1 billion to modernize school and college facilities.

The Wall Street Journal reports that the switch to direct loans will mean “taxpayers will have to put up roughly $100 billion per year to lend to students.”

Colleges and universities have been generally skeptical about the switch to direct lending. The worry is that the Department of Education’s record of “customer service” on its existing direct student loan programs isn’t very impressive. The existing federal direct lending handles about 22 percent of student loans. If HR 3221 becomes law, federal direct lending to students will comprise about 80 percent of student loans. Will quadrupling the size of federal direct lending to students and turning it into a virtual monopoly make it better?

Background

I suspect not, but it is hard to have much sympathy with the commercial lenders who stand to lose their subsidized student loan business. We are just two years removed from the fetid scandal in which, thanks largely to the investigations of New York State Attorney General Andrew Cuomo beginning in January 2007, we learned of widespread bribery of college officials by many of these companies and sweetheart deals in which colleges were financially rewarded for steering students into loans on worse terms than they could have gotten elsewhere. The scandal was broad and deep. It included the fantastically corrupt Nebraska-based loan consolidator Nelnet, which manipulated federal incentives to walk away with hundreds of millions of dollars it didn’t deserve. It included a federal whistleblower who was silenced when he tried to bring these corrupt practices to light. It included the now notorious Wall Street practice of “securitizing” student loans by bundling them together and selling them as bonds—the same sorts of instruments that drove the housing bubble.

In 2007 and 2008, Congress lurched from one extreme intervention to another in an effort to get ahead of the snowballing scandal. It passed one bill in September 2007 (the “College Cost Reduction and Access Act), that “punished” the greedy student loan companies by yanking away much of their incentive to offer the loans. The unanticipated result was that numerous lenders simply quit the business. Faced with the prospect that millions of students would be squeezed out of the loan market in fall 2008, Congress intervened again in May 2008, with a bill that authorized the Department of Education to buy up loans from lenders. I wrote about this in Igloo Building: A Primer on the Financial aid Fiasco. It was, in essence, a trial run of the policy subsequently launched during the financial meltdown to buy up the “toxic debt” of banks and investment houses that had gorged on mortgage securities stuffed with non-performing subprime housing loans.

So, no, I have no great sympathy for the student loan companies. They have been inefficient, often corrupt, greedy, and near-sighted. At the same time, I expect the Department of Education’s management of the direct student loan program to be even worse.

The Congressional debate over HR 3221 already points the way to more chicanery. House Democrats have explained that the bill will “save” $87 billion a year. That represents the loans made by private lenders under the old program. Of course, this money won’t be saved at all. It will simply be lent by the taxpayers rather than the banks. The Wall Street Journal has covered this accounting gimmick and quoted a letter from Congressional Budget Office direct Douglas Elmendorf to Senator Judd Gregg in which Elmendorf acknowledges the accounting has been manipulated to make the direct federal loans look less expensive than the private loans.

In principle, I would think a reformed and better regulated system of private lending would serve students and the nation better than a “single payer” student loan system. To be sure, the direct lending program of HR 3221 isn't entirely single payer. It cuts out commercial subsidized student loan companies, but would leave about 20 percent of the market, consisting of unsubsidized student loans to commercial lenders. These lenders typically cover the gap left when a student has maxed out on federal loans and grants and other financial resources and still needs more money to meet college bills.

Investing in Illusions

So why did the House of Representatives reject the idea of reforming a system that has been in place for over forty years in favor of such a radical alternative? The proponents of the bill argued that it would save money—that imaginary $87 billion that even the director of the Congressional Budget Office admits is a fantasy. If we assume the bill’s supporters weren’t that stupid, we need to look elsewhere for their real motive.

Another part of the official explanation trades in familiar rhetoric. Congressman Miller declares, “This legislation provides students and families with the single largest investment in federal student aid ever and makes landmark investments to improve education for students of all ages -- and all without costing taxpayers a dime.” So it is an “investment” and it will “improve education.”

And we add to this that it provides a timely legislative victory to President Obama, who strongly backs the measure and lauded its passage. Obama claimed the bill will (1) “offer relief to students and families," (2) “end the billions upon billions of dollars in unwarranted subsidies that we hand out to banks and financial institutions,” (3) “make college more affordable,” and (4) “follows through on our plan to shore up our community college system, simplifies the complicated financial aid forms to make it easier for students to apply for and get the help they need, and will strengthen standards and improve outcomes in early learning programs."

Let’s take these one by one.

President Obama says the bill will “offer relief to students and families." Not really.

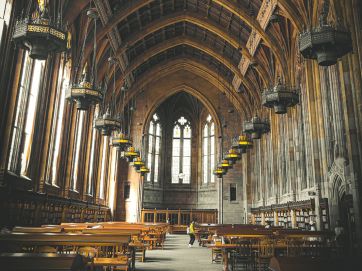

It is pretty much a settled fact of market economics that government subsidies don’t actually make things less expensive. Suppliers know full well the subsidies are there and adjust their prices and behavior accordingly. In the case of higher education, each increase in federal support is pretty quickly absorbed into higher tuition and fees. Where does the new money go? Building programs, posh new dormitories, a huge proliferation of ideology-based programs based on identity groups, an 80 percent increase in the number of full-time faculty in the last 20 years, an even steeper increase in the non-teaching professional staff, and lots of amenities.

One would think by now that a politician promising to make college more affordable by increasing the level of grants and loans would be met with outright laughter. Every few years we go through this exercise and college costs mysteriously keep rising in tandem with the increases in government largesse. But of course there is a difference between system-level effects and individual situations. If you are a student starting out, that bump up in a grant or a loan feels real. The letter from the college president announcing the tuition increase won’t arrive for another nine months.

President Obama says the bill will “end the billions upon billions of dollars in unwarranted subsidies that we hand out to banks and financial institutions.”

The Congressional Budget Office says otherwise, as does common sense. I am no apologist for the companies that lived off subsidized student loans. There is surely some money to be saved by ending Nelnet-style abuses, but those in fact seem to have been remedied already. “Billions upon billions of dollars in unwarranted subsidies” don’t exist. The best estimate of overall administrative costs in the in commercial subsidized student loan industry is $7 billion out of the $87 billion in spending. Will the Department of Education spend less?

President Obama says the bill will “make college more affordable.”

Not for the taxpayer and not for most students. The billions of new spending on Pell Grants, however, will surely put college in reach for more students. Whether this is good public policy, however, is debatable. We already have a surplus of college graduates in relation to jobs that actually require a college degree to be performed well. The result is millions of Americans who spend a decade or more under-employed in queue for the positions where a college education makes a difference. We also have rampant credential inflation, with students seeking graduate degrees simply to land entry level positions. Making college “more affordable” means still more graduates competing for scarce positions.

I know, I know. This runs counter to the great wish-fulfillment of our age in which “everybody” is entitled to a college education and really ought to get that degree, as though no other path though life could be worthy. Tom Wood has written on this site about the evidence that attending college really does improve the critical intelligence of anyone—at least a little—no matter how ill-prepared or intellectually dim the student. I’m inclined to think he has made his case, but assuming it is true, we are still left with the question of whether sending ever greater cohorts to college is good public policy. It has costs beyond the taxpayer. It can end up channeling people into unproductive and unhappy lives by training them for work for which they are ill-suited. It can waste formative years that might be better spent developing on a different path. It can erode the quality of a college or university by filling up classes with students who are bored or incapable. It can thus harm the education of those who are bright and ambitious and that society has a stake in educating up to a more demanding standard.

It isn’t hard to discern the drawbacks of “college is for everyone.” But we almost never talk about them. Why is that?

Instead President Obama has enunciated a plan to have 40 percent of Americans under age 35 attain college degrees by 2020. That would make Americans the most college-degreed people in the world, and it would require roughly doubling the number of students now attending college from 18 million to 36 million.

With that as his announced plan, it is not hard to see why President Obama applauds the idea of making college “more affordable” and presumably more popular.

We can tell ourselves as often as we want that those college degrees will make individuals prosperous and happy, and our society more competitive in the global economy. But those are catchphrases, not ineluctable truth. A college degree doesn’t guarantee a good job, let alone a prosperous career. Colleges these days spend a great deal of effort attempting to implant in students an abiding sense of alienation from their culture, their nation, and their families. A college degree is certainly no recipe for personal happiness. More often it inculcates ironic disdain and aimless discomfort.

As for global competition, I don’t believe there is a magic percentage of the population holding college degrees that guarantees a leg up in the world economy. Some fields require workers who are highly skilled, intellectually disciplined, and mentally agile. Most fields don’t. But nearly every field requires people who are trustworthy, honorable, alive to the larger purposes of life, and in command of basic skills of literacy and numeracy. Our position in global competition would be mightily enhanced if our school system rose to a decent level of proficiency. A great assembly line of college degrees, however, is not a requirement.

President Obama says the bill “follows through on our plan to shore up our community college system, simplifies the complicated financial aid forms to make it easier for students to apply for and get the help they need, and will strengthen standards and improve outcomes in early learning programs."

I have no dissent here. HR 3221may do all these things. I am not entirely at ease with the idea that they are intrinsically worth doing, but the bill does indeed advance his agenda. The most positive part of this agenda is the new emphasis on community colleges.

Why It Matters

Three or four times a year I write articles on the financial side of higher ed. I do so mostly out of a sense of obligation. Scholars and teachers and those who care about the future of higher education ought to be attentive to this subject, but I know that most are not. Student loans and financial issues tend to be left to the specialists. As a result, we get very little intelligent or well-informed analysis of these matters. The Wall Street Journal nicely framed this story as “The Quietest Trillion.” It notes that the “trillion-dollar restructuring of American health care has left the other trillion-dollar plan starved for attention: "That’s how much the federal balance sheet will expand over the next decade if Mr. Obama can convince Congress to approve his pending takeover of the student-loan market.”

Well, shame on me for failing to find the way to tell this story in a way that would get sensible academics and the general public worked up. Surely the point here is not the fantastic amounts of money. Nor is it the disingenuousness of the explanations. Nor is it even the vainglorious idea of sending more and more people to college for no good reason and a lot of bad ones.

The point is that a system of higher education predominantly funded by one agency of the federal government is a system that cannot possibly retain its intellectual independence and vitality. American colleges and universities will in this new system become more and more the purveyors of an “education” that suits the bureaucrats and the politicians in Washington. That’s reason for worry not just for conservatives and libertarians, but for liberals too. Concentrating this much power in one place is the sure path to political subordination, and a profound loss of freedom and autonomy.

I wish I had better words for this. I’ll keep trying.